spooncms.ru Tools

Tools

What Do I Need To Open Wells Fargo Account

© Wells Fargo Bank, N.A. All rights reserved. Member FDIC. CNS IHA — If your current address does not match your government-issued ID. You can open a Wells Fargo online checking account here. You'll need your Social Security Number, a valid ID and a $25 opening deposit that you can easily. $ minimum daily balance · $ or more in total qualifying electronic deposits · The primary account owner is 17 - 24 years old · A linked Wells Fargo Campus. Minimum opening deposit is $ Provide later with required business documents when you apply online. Apply online below or make an appointment to apply in. Assuming that you don't want to pay the monthly maintenance fee, you need to maintain a $1, minimum balance for the Total Checking product. Do I need to link my WellsTrade account to my existing Wells Fargo Bank Prime Checking or Premier Checking account? When opening a business checking or savings account, we are required by law to verify your business as well as the individuals associated with your business. Valid ID (driver's license, state ID, Consular ID); Current residential address; $25 minimum opening deposit. IDs required to open (plus co-applicant's. Must be 13 or older · Teens 13 – 16 years old need an adult co-owner · 17 and under must open at a branch · IDs required to open. © Wells Fargo Bank, N.A. All rights reserved. Member FDIC. CNS IHA — If your current address does not match your government-issued ID. You can open a Wells Fargo online checking account here. You'll need your Social Security Number, a valid ID and a $25 opening deposit that you can easily. $ minimum daily balance · $ or more in total qualifying electronic deposits · The primary account owner is 17 - 24 years old · A linked Wells Fargo Campus. Minimum opening deposit is $ Provide later with required business documents when you apply online. Apply online below or make an appointment to apply in. Assuming that you don't want to pay the monthly maintenance fee, you need to maintain a $1, minimum balance for the Total Checking product. Do I need to link my WellsTrade account to my existing Wells Fargo Bank Prime Checking or Premier Checking account? When opening a business checking or savings account, we are required by law to verify your business as well as the individuals associated with your business. Valid ID (driver's license, state ID, Consular ID); Current residential address; $25 minimum opening deposit. IDs required to open (plus co-applicant's. Must be 13 or older · Teens 13 – 16 years old need an adult co-owner · 17 and under must open at a branch · IDs required to open.

Account Management •Access your cash, credit, and investment accounts with Fingerprint Sign On¹ or Biometric Sign on¹ •Review activity and balances. You'll need to make a minimum opening deposit of $25 to open a checking account with Wells Fargo. Does Wells Fargo offer a welcome bonus for opening a new. $10, in combined minimum daily balance; $1, or more in qualifying electronic deposit; Linked Home Mortgage account. New account. Everyday Checking. $ It's never too early to start saving · Open a Way2Save® Savings account with $25 · Open at a branch Open online. Two forms of identification (ID) are needed to open at a branch · Employee ID · Student ID · Credit card · ID issued by a recognized business or government agency. U.S. checking or savings account required to use Zelle®. Transactions between enrolled users typically occur in minutes. For your protection, Zelle® should only. Minimum $ to open a new Wells Fargo checking account. Transfers from one accounts requires continued automatic payment from a Wells Fargo checking account. You can open most of our business accounts with a minimum opening deposit of $ What documentation is required to open a business account?Expand. Visit What. Checking account: A checking account can be opened individually or jointly, and youll need your basic information, Social Security number, drivers license, and. Other documents may be needed depending on the state in which the accounts were opened or state of residence. The Estate Care Center team will help you. What do I need to open a checking account online?Expand. Must be 18 or older How do I open a joint checking account?Expand. Joint checking accounts. You'll only need $25 to open a Wells Fargo Prime checking account, but you'll need at least a $20, total balance in qualifying accounts at Wells Fargo to. A bank wire transfer. You will need to be signed up with your bank first for online banking. You will need the name of the person, their bank. Open an Everyday Checking account with a minimum opening deposit of $25 from this offer webpage. Complete the qualifying requirements to receive your $ Open a new checking account with a minimum $25 deposit. The offer page specifies that you'll need to open an Everyday Checking account for this offer. Need to open an account or apply for a loan? Explore convenient and secure ways to open checking, savings, and CD accounts, or apply for loans and credit. Whether you open an account in person or online, you'll need to provide personal information such as your full name, date of birth, Social Security number and. You want to do this because this will effectively allow you to put all your money your SoFi Savings account so that all your cash earns %. I do it all the time, but it sounds like you only have one account. You should have a minimum of two checking accounts. You just might want to. When you apply to open a checking or savings account at a bank or credit union in the U.S., the financial institution will need to verify your name, date of.

Retirement Money For Home Purchase

Generally, with either plan, if you are under age 59 ½ and take money out of the fund, you will incur a 10% early withdrawal penalty (plus whatever penalty your. Before you decide to tap into your Texa$aver account, make sure you understand how a loan could impact your retirement savings. Employees who participate in the. Under the federal government's Home Buyers' Plan, first-time home buyers can use a portion of your RRSP savings to help finance a home down payment. Retirement plans may offer loans to participants, but a plan sponsor is not required to include loan provisions in its plan. Profit-sharing, money purchase. Some people choose to downsize for retirement or transition to a rental arrangement. In these cases, they are going to be sitting on some cash — potentially, a. Vested funds from individual retirement accounts (IRA/SEP/Keogh accounts) and tax-favored retirement savings accounts ((k) accounts) are acceptable sources. You can use the money you've invested in a retirement account, such as a (k) or IRA, to help purchase a home. purchase a home. In order to avoid legal or tax problems, it's Related articles. Will you outlive your money in retirement? 3 risks to plan. There are no penalties for pulling from your retirement savings for a first time home purchase where I live. My husband pulled from his. Generally, with either plan, if you are under age 59 ½ and take money out of the fund, you will incur a 10% early withdrawal penalty (plus whatever penalty your. Before you decide to tap into your Texa$aver account, make sure you understand how a loan could impact your retirement savings. Employees who participate in the. Under the federal government's Home Buyers' Plan, first-time home buyers can use a portion of your RRSP savings to help finance a home down payment. Retirement plans may offer loans to participants, but a plan sponsor is not required to include loan provisions in its plan. Profit-sharing, money purchase. Some people choose to downsize for retirement or transition to a rental arrangement. In these cases, they are going to be sitting on some cash — potentially, a. Vested funds from individual retirement accounts (IRA/SEP/Keogh accounts) and tax-favored retirement savings accounts ((k) accounts) are acceptable sources. You can use the money you've invested in a retirement account, such as a (k) or IRA, to help purchase a home. purchase a home. In order to avoid legal or tax problems, it's Related articles. Will you outlive your money in retirement? 3 risks to plan. There are no penalties for pulling from your retirement savings for a first time home purchase where I live. My husband pulled from his.

Some people may choose to tap their retirement balances for down payment money through a (k) loan or early withdrawal. This isn't a decision to consider. You can borrow money from your retirement plan and pay the funds back with lower interest rates than other types of borrowing, such as a credit card. The lender makes payments to the homeowner, who maintains ownership of the home throughout his or her life. However, there are nuances to reverse mortgages, and. Fannie Mae and Freddie Mac have senior home buying programs that allow you to use eligible retirement assets to qualify for a mortgage. These programs may. Bottom line, using those retirement funds to purchase a home can be a great option. But always speak to your financial professional to determine how to best. Most (k) loans must be repaid within five years, although you may be able to get a longer repayment term if you use the funds to buy a home. Rules for. Using your retirement funds and taking a loan is not “paying cash”. You owe for the loan and need to replace your retirement funds. Work on that. We talked to Sara, an Atlantic Canadian who recently purchased her sixth investment property as part of her diverse retirement plan. Sara knew since her early. NJHMFA's Police and Firemen's Retirement System Mortgage Program (first-time buyer, trade up or trade down). Active members of the New Jersey Police and. How Much Can a First-Time Buyer Withdraw From an IRA? · Who Is a First-Time Home Buyer for Purposes of IRA Withdrawals? · Timeline for Using IRA Money for a Down. I'm a CPA. You can take out money from your k without penalty for a home, but you'll still be charged the taxes. It's possible to use funds from an individual retirement account, penalty-free, to buy a house, even if you aren't six months away from your 60th birthday. What is it? Épargne Placements Québec's registered retirement savings plan (RRSP) gives you the option of temporarily withdrawing funds under the Home. When considering purchasing a home in Florida using your retirement savings, it's crucial to understand the specific steps involved in this process. If you're a. In fact, it is possible to use both your k and individual retirement accounts (IRAs) to invest in real estate. And contrary to popular belief, it is possible. The Home Buyers' Plan (HBP) allows you to withdraw from a registered retirement savings plan to buy a home. Learn more about HBP in our latest article. As much as you may need the money now, by taking a distribution or borrowing from your retirement funds, you're interrupting the potential for the funds in your. Using your retirement funds and taking a loan is not “paying cash”. You owe for the loan and need to replace your retirement funds. Work on that. A retirement plan loan must be paid back to the borrower's retirement account under the plan. The money is not taxed if loan meets the rules and the repayment. Retirement Funds as Income to Qualify for a Home Mortgage Loan Using Retirement Funds As Income Retirement Funds As Income to Qualifying for a home mortgage.

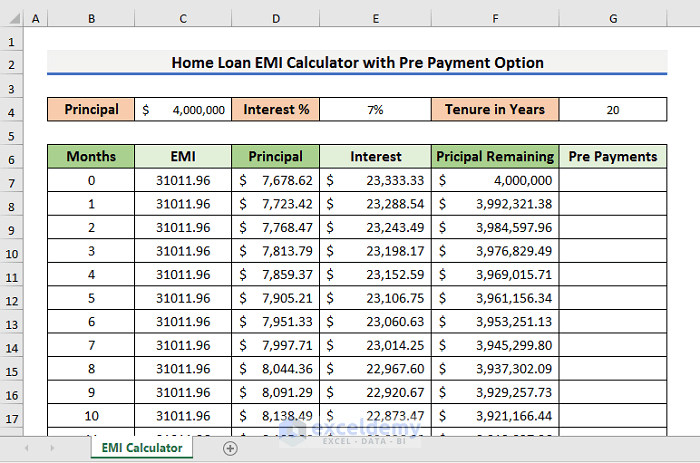

Home Loan Eligibility Calculator

These home affordability calculator results are based on your debt-to-income ratio (DTI). Industry standards suggest your total debt should be 36% of your. Home loan EMI calculator helps you calculate the EMI amount payable towards your home loan based on rates of interest and loan tenure. Use our online home. Our mortgage affordability calculator helps you determine how much house you can afford quickly and easily with the applicable mortgage lending guidelines. It is a simple online tool that requires them to provide some basic details, like monthly income, additional income, loan tenure, city of property, current. Calculate your home loan eligibility online with Grihum Housing Finance. This calculator will give you Home loan Eligibility amount and monthly EMI amount. calculate your monthly payments to determine your price range and home loan options Mortgage affordability calculator. Get an estimated home price and. Using the Axis Bank Home Loan Eligibility Calculator is pretty simple. Just enter your details like age, income, other EMIs, net monthly income, and interest. A home loan eligibility calculator is an online tool that enables you to assess your home loan eligibility in just a few clicks with some simple steps. SBI Home Loan EMI calculator is a basic calculator that helps you to calculate the EMI, monthly interest and monthly reducing balance. These home affordability calculator results are based on your debt-to-income ratio (DTI). Industry standards suggest your total debt should be 36% of your. Home loan EMI calculator helps you calculate the EMI amount payable towards your home loan based on rates of interest and loan tenure. Use our online home. Our mortgage affordability calculator helps you determine how much house you can afford quickly and easily with the applicable mortgage lending guidelines. It is a simple online tool that requires them to provide some basic details, like monthly income, additional income, loan tenure, city of property, current. Calculate your home loan eligibility online with Grihum Housing Finance. This calculator will give you Home loan Eligibility amount and monthly EMI amount. calculate your monthly payments to determine your price range and home loan options Mortgage affordability calculator. Get an estimated home price and. Using the Axis Bank Home Loan Eligibility Calculator is pretty simple. Just enter your details like age, income, other EMIs, net monthly income, and interest. A home loan eligibility calculator is an online tool that enables you to assess your home loan eligibility in just a few clicks with some simple steps. SBI Home Loan EMI calculator is a basic calculator that helps you to calculate the EMI, monthly interest and monthly reducing balance.

In the case of a home loan, EMI is restricted to a maximum of 40% to 50% of the net income (monthly) by most banks. This suggests that you are eligible for a. To be eligible for a home loan, several factors are considered, including your salary, age, credit score, location, work experience, and monthly financial. Single Family Housing Income Eligibility. Property Location. State: Please pick a state below, Alabama, Alaska, Arizona, Arkansas, California, Colorado. Quickly find out the loan amount that you can afford to borrow from banks in Malaysia based on simple financial profiling, using our industry verified tool. Use our free mortgage affordability calculator to estimate how much house you can afford based on your monthly income, expenses and specified mortgage rate. Try our free mortgage calculators to find out how much home you can afford, how much you could borrow and calculate your monthly loan payments with U.S. Calculate and compare your home loan eligibility in Malaysia. Just provide your employment details, salary, current earnings and commitments, and the report. Calculate the EMI that you will be required to pay for your home loan with our easy to understand home loan EMI calculator. Home Loan EMI Calculator helps you calculate monthly EMI & interest payable. Use ICICI Bank's Home Loan Calculator to know your EMI. Single Family Housing Income Eligibility. Property Location. State: Please pick a state below, Alabama, Alaska, Arizona, Arkansas, California, Colorado. Home Loan Eligibility Calculator is an online tool that calculates your eligibility for home loan in seconds. Check your loan amount eligibility now. EMI Calculator / Loan Eligibility Calculator. Gross Monthly Income Rs. Total Current EMI's Rs. Interest Rate % Loan Term Months. Estimate your monthly mortgage payment with our easy-to-use mortgage calculator. VA Mortgage Calculator. Use our VA home loan calculator to estimate payments. Formula to determine Home Loan EMI amount · P is the principal loan amount · r is the monthly interest rate (annual rate divided by 12) · n is the number of. Use the home loan eligibility calculator to check whether you qualify for a home loan and how much you can borrow. Most lenders base their home loan qualification on both your total monthly gross income and your monthly expenses. These monthly expenses include property. With Tata Capital Home Loan Eligibility Calculator, you can check if you're eligible to borrow a home loan with us and if yes, then the maximum home loan. Quickly find out the loan amount that you can afford to borrow from banks in Malaysia based on simple financial profiling, using our industry verified tool. Get an estimate of how much you can afford with our affordability calculator. Provide your financial situations to check if you're eligible. All you have to do is enter the loan amount, interest rate and the loan tenure in years. The exact EMI value will be calculated and displayed within seconds.

Al Brooks Futures

Al Brooks Trading runs several paid courses that investors can use to learn how to read the markets through charts and price action. Brooks Price Action team member. Teaching/trading along side of Al Brooks trade SP Futures charts. spooncms.ru #traderoom. I learned price action from al brooks. He's my biggest influence. The books are dense, but you can learn everything you need to know to trade price action with. And since he trades more than just E-mini S&P futures, Brooks also Brooks, Al, Reading price charts bar by bar. ISBN: Al Brooks Narrated by: Mike Fraser Length: 25 hrs and 33 mins Over the course of his career, author Al Brooks, a technical analysis contributor to Futures. Al Brooks, MD—Trader, Technical Analyst, Author, CME Lecturer, Futures magazine · Experience: Brooks Price Action, LLC · Education: University of Chicago. A complete archive of Al Brooks's articles, including current analysis & opinion. Al Brooks, Brooks Trading Course, and Brooks Price Action, Sacramento, California. likes · 91 talking about this. Learn how to swing trade and day. Nobody understands this better than author Al Brooks, a technical analyst for Futures magazine and an independent trader for more than twenty years. Brooks. Al Brooks Trading runs several paid courses that investors can use to learn how to read the markets through charts and price action. Brooks Price Action team member. Teaching/trading along side of Al Brooks trade SP Futures charts. spooncms.ru #traderoom. I learned price action from al brooks. He's my biggest influence. The books are dense, but you can learn everything you need to know to trade price action with. And since he trades more than just E-mini S&P futures, Brooks also Brooks, Al, Reading price charts bar by bar. ISBN: Al Brooks Narrated by: Mike Fraser Length: 25 hrs and 33 mins Over the course of his career, author Al Brooks, a technical analysis contributor to Futures. Al Brooks, MD—Trader, Technical Analyst, Author, CME Lecturer, Futures magazine · Experience: Brooks Price Action, LLC · Education: University of Chicago. A complete archive of Al Brooks's articles, including current analysis & opinion. Al Brooks, Brooks Trading Course, and Brooks Price Action, Sacramento, California. likes · 91 talking about this. Learn how to swing trade and day. Nobody understands this better than author Al Brooks, a technical analyst for Futures magazine and an independent trader for more than twenty years. Brooks.

Over the course of his career, author Al Brooks, a technical analysis contributor to Futures magazine and an independent trader for twenty-five years, has found. From the Back Cover Praise for Trading Price Action Trading Ranges Al Brooks has written a book every day trader should read. On all levels, he has kept. Trading Nut | Podcasts & Free Courses on Forex, Futures & Stocks al-brooks-strategy. by Cam | Jul 13, | 0 comments. Submit a Comment Cancel reply. Al Brooks is a technical analysis contributor for Futures magazine and an independent day trader. His approach to reading price charts was developed over. For many years, he was a technical analysis contributor to Futures magazine. He provides live market commentary in his Trading Room ($99/month) and end-of-day. Over the course of his career, author Al Brooks, a technical analysis contributor to Futures magazine and an independent trader for twenty-five years, has found. spooncms.ru - Free download as PDF File .pdf), Text File .txt) or read online for free. Al Brooks received his MD degree from the University of Chicago and changed careers from eye surgery to day trading more than 30 years ago, specializing in. Al Brooks, a professional trader with a medical background, has managed to marry scientific precision with the chaos of trading markets. His intricate. Al Brooks. E-Book, O-Book, Print. Starting at $ Learn More. Following the Trend. Al Brooks, MD, has been a professional trader for more than 30 years. He is an international lecturer on trading and the author of several best-selling trading. If you want to be serious about trading and really know how to make money, Al Brooks is the one you should follow, He received his MD degree. Al Brooks High/Low 1, 2, 3, 4 Al Brooks is trading E-mini S&P futures on 5-minute Chart. The only indicator on his chart is a period EMA. About the Author: AL BROOKS is a technical analysis contributor for Futures magazine and an independent day trader. Pages. Business + Money Management. Throughout his journey, Al's is deliberately focused on trading price action. According to what he describes, he scalps the future market every weekday by. Al Brooks · Favorite Trading Books: MD degree from the University of Chicago. · Favorite Trading Magazines: Modern Trader Futures Magazine. Al has lectured internationally and has taught thousands of traders how to trade. Coined the trader's trader by Futures magazine, Al is the author several. Brooks Trading Course Weekend Reports: Sunday August 11, Emini, EURUSD, Crude Oil, Nasdaq , Bitcoin, FTSE , DAX 40 and Nifty Brooks, Al, – Reading price charts bar by bar. II. Title. HGB Futures charts, and I believe that reading price action well is an invaluable. Now, in the second book, Trading Price Action TRADING RANGES, Brooks offers insights on trading ranges, breakouts, order management, and the mathematics of.

Home Interest Rates Dropping

View data of the average interest rate, calculated weekly, of fixed-rate mortgages with a year repayment term. If mortgage rates drop, then more people will be able to afford to buy homes. This will drive housing rates up because there will be more buyers. Mortgage rates remained flat this week as markets await the release of the highly anticipated August jobs report. Even though rates have come down over the. The year fixed mortgage rate has come down by nearly half-a-point in the past month alone. Rate cuts may be 'priced in,' with mortgage lenders having already. “However, if your rate is % or lower, it might make sense to wait until , as we're expecting rates to drop to the mid-5% range by mid-year.”. – federal rate changes The string of consistent interest rate increases prompted mortgage rates to rise steadily in and , exceeding pre-. However, even when the Fed does start to cut rates, we shouldn't expect a dramatic reduction, according to Jacob Channel, LendingTree's senior economist. Mortgage Rates News ; Mortgage rates falling to 5% would get this party started. Sep 05, · Jeff Andrews ; Mortgage affordability improves in August, boosting. Today. The average APR on the year fixed-rate jumbo mortgage is %. Last week. %. Mortgage Rate Trends. View data of the average interest rate, calculated weekly, of fixed-rate mortgages with a year repayment term. If mortgage rates drop, then more people will be able to afford to buy homes. This will drive housing rates up because there will be more buyers. Mortgage rates remained flat this week as markets await the release of the highly anticipated August jobs report. Even though rates have come down over the. The year fixed mortgage rate has come down by nearly half-a-point in the past month alone. Rate cuts may be 'priced in,' with mortgage lenders having already. “However, if your rate is % or lower, it might make sense to wait until , as we're expecting rates to drop to the mid-5% range by mid-year.”. – federal rate changes The string of consistent interest rate increases prompted mortgage rates to rise steadily in and , exceeding pre-. However, even when the Fed does start to cut rates, we shouldn't expect a dramatic reduction, according to Jacob Channel, LendingTree's senior economist. Mortgage Rates News ; Mortgage rates falling to 5% would get this party started. Sep 05, · Jeff Andrews ; Mortgage affordability improves in August, boosting. Today. The average APR on the year fixed-rate jumbo mortgage is %. Last week. %. Mortgage Rate Trends.

This drop coincides with a decline in long-term Treasury yields, as ongoing apprehensions regarding economic growth in the US have led investors to gravitate. Houses haven't come down since the - interest rates increase. I wouldn't bet on housing changes based on what you think will happen. Since the rate is used by most banks as the baseline interest rate, any increases or decreases will cause your adjustable-rate mortgage payments to fluctuate. Are Canadian housing prices dropping? Despite the growing housing supply, sellers haven't been slashing prices as much as expected, Mercer said. "You hear the. Mortgage rates have fallen four months in a row, and they'll probably extend the streak by going down in September too. There are two related reasons: Inflation. The year fixed mortgage rate is expected to fall to the low-6% range through the end of , potentially dipping into high-5% territory in Buy your home now, and if rates drop later, you could lower your rate without refinancing for a one-time $ fee. No Private Mortgage Insurance Required. Most. If our mortgage rates drop after 6 months, you could lower your rate without refinancing—saving you thousands on closing costs and lowering your monthly payment. We may see fixed rates decline a further % to % as interest rates trend down — but don't count your rate chickens until we see how the economy reacts to. “If inflation growth does start to slow, the Fed may still choose to cut rates in the second half of the year. If they do, mortgage rates should drop.” If you'. The average rate on a year fixed-rate mortgage went down three basis points to % APR, and the average rate on a 5-year adjustable-rate mortgage went. View today's current mortgage rates with our national average index, calculated daily to bring you the most accurate data when purchasing or refinancing. If interest rates drop after you've locked in your rate, but before your closing, you can request a Mortgage rate float down. It marks a fifth consecutive week of falling borrowing costs, staying below % a year ago, as prospects the Fed will soon start cutting the interest rates. We'll waive our lender closing costs on your next refinance if rates drop—that's a savings of $1,! Don't delay! Get started now or contact us at With the Federal Reserve (Fed) indicating that interest rate cuts are coming, the real estate market is looking up. Mortgage rates in late August fell to. Today's year fixed VA refinance loan rate stands at %. See more rates, including assumptions, in the table below. Current VA Mortgage Rates. VA loan. High interest rates are the new norm. They will be here for a while. Keep in mind more than 30% of all home owners have a mortgage rate of 3% or. Mortgage rates are again hovering at their lowest levels of the year ahead of tomorrow's important BLS Jobs Report. The year fixed rate currently sits at. Find average mortgage rates for the 30 year fixed rate mortgage from a variety of sources including Mortgage News Daily, Freddie Mac, etc.

Cars To Finance With No Credit

While financing a car with no credit or with bad credit may be a bit more difficult than it would be if you had established credit, it's not impossible. If you still have bad credit, we can offer Subprime leases and loans if you need a vehicle. These types of leases and loans will have more restrictive. Our answer is yes. Our financiers have access to national lenders and have the flexibility needed to offer bad credit car finance or no credit car finance. Guaranteed security. Having a family member or friend with good financial status and credit history act as a guarantor application could improve your chances of. Addressing Bad Credit Concerns At Merchants Auto, we don't believe that past financial missteps should prevent you from purchasing a reliable vehicle. Prequalifying for an auto loan can help you find out how much you can borrow. Save time, estimate payments and be ready to buy with no credit score impact. The first thing you need to keep in mind when you're financing a car with no credit is that your down payment may be more than average and interest rates may be. Your credit approval. Do you have bad credit and are looking for a car loan with guaranteed approval? Credit Acceptance empowers car dealers nationwide to help. Credit Acceptance empowers car dealers nationwide to help people finance a car, regardless of bad credit or no credit. If you are shopping for a new or used. While financing a car with no credit or with bad credit may be a bit more difficult than it would be if you had established credit, it's not impossible. If you still have bad credit, we can offer Subprime leases and loans if you need a vehicle. These types of leases and loans will have more restrictive. Our answer is yes. Our financiers have access to national lenders and have the flexibility needed to offer bad credit car finance or no credit car finance. Guaranteed security. Having a family member or friend with good financial status and credit history act as a guarantor application could improve your chances of. Addressing Bad Credit Concerns At Merchants Auto, we don't believe that past financial missteps should prevent you from purchasing a reliable vehicle. Prequalifying for an auto loan can help you find out how much you can borrow. Save time, estimate payments and be ready to buy with no credit score impact. The first thing you need to keep in mind when you're financing a car with no credit is that your down payment may be more than average and interest rates may be. Your credit approval. Do you have bad credit and are looking for a car loan with guaranteed approval? Credit Acceptance empowers car dealers nationwide to help. Credit Acceptance empowers car dealers nationwide to help people finance a car, regardless of bad credit or no credit. If you are shopping for a new or used.

Drive Now Auto Credit is here to help you purchase a quality used vehicle and get the financing that works for your budget. WITHOUT a credit check! Can you finance a car with no credit? While financing a car with bad credit isn't always as easy as financing a car with good credit, it definitely can be. Looking to purchase a used car but feel stuck by having bad credit? No need to worry, Nexcar has an easy solution for bad credit auto loan. Looking for no credit or bad credit auto loans around Phoenix, Tuscon or Mesa? Head on over to Cactus Jack's Automotive. We have dealerships all over. Buying a car with no credit history? Use our auto loan calculators to see what you can afford and explore Regions auto loan options. We've been one of the leading bad credit auto dealers in Michigan for nearly as long. Our financing experts are ready to walk you through our finance process. Crosstown Chrysler Dodge Jeep Ram finance department specializes in providing you with a great way to get just that! At Maxon Hyundai, we are dedicated to helping our customers get the vehicles they need, even if they have bad credit or no credit. Even if you have been through. If you have bad credit or no credit Carvana can still get you financing. With over 99% applicants approved you can get pre-qualified with a real offer in. Burdick Used Car Warehouse in Syracuse, NY is an affordable used car dealership for all used car shoppers on a budget, even if you have bad credit or no credit. Our finance department specializes in helping those with no credit or bad credit get approved thanks to the relationships we have with dozens of local banks. Bad Credit? No Credit? No problem! Central Avenue Nissan will work with you regardless of your credit history and help you buy the car you need. A bad credit car loan is a type of financing provided to someone who has a tarnished credit rating. This negative rating may have been caused by a mortgage. Team up with Yonkers Honda in Yonkers, New York today to take charge of your less than perfect credit score! Our team understands how bills can pile up and how. To apply for a low credit auto loan or sub-prime car loan, fill out our secure online credit application below. Once our auto finance specialists review your. A subprime car loan can be a good option for anyone who has a low credit score, an inconsistent credit history or no credit history. While you generally need to. Auto Sales offers car loans for No credit, Good or Bad Credit situations in Nova Scotia, Canada. Did you know we Go Beyond Our Inventory? Call us! All types of credit, from good to bad, can qualify for an auto loan. No credit, no problem! We will work with you to secure a no credit car loan if your. Is Financing a Car with No Credit Possible? Car Key. Yes, you can! While it may be more difficult, it's not impossible. Learn more about no credit car loans and. CNBC Select compared more than a dozen car loan lenders based on the types of loans offered, affordability, credit requirements and shopping experience they.

How To Get A Discount On Amazon Prime

Can you tell me more about what's going on? Customer: Would like to see if I qualify for the senior discount if I'm on disability which is I get social security. Make savings at Amazon Prime Discount Codes on August We've tried and tested all the best discount codes, so all you need to do is watch the price tag. there is one way to get it, just take prime membership, go to payment page, select HDFC net banking and proceed it, but don't pay just back that. Yes, Amazon often runs special promotions and deals during holidays like Black Friday, Cyber Monday, Prime Day, and other seasonal events. Is there a way to get. 1. Join Amazon Student · 2. Get an EBT or Medicaid Discount · 3. Spend $25 or More · 4. Get a Subscribe & Save Membership · 5. Swap Amazon Prime for Walmart+. They get exclusive deals on select everyday favorites, essentials, prepared foods, and more at Amazon Fresh stores—and a discount off hundreds of sale items. Call Amazon, if this is the first time you are getting the membership they might be able to give you a discount. Upvote Downvote Reply. Start your 6-month trial and then enjoy Prime at half the price. As a member, you'll get access to fast FREE shipping, Prime Video originals. If you are a non-student young adult ( years old) and join Prime Student through age verification, when you reach 25 years old, your Prime Student. Can you tell me more about what's going on? Customer: Would like to see if I qualify for the senior discount if I'm on disability which is I get social security. Make savings at Amazon Prime Discount Codes on August We've tried and tested all the best discount codes, so all you need to do is watch the price tag. there is one way to get it, just take prime membership, go to payment page, select HDFC net banking and proceed it, but don't pay just back that. Yes, Amazon often runs special promotions and deals during holidays like Black Friday, Cyber Monday, Prime Day, and other seasonal events. Is there a way to get. 1. Join Amazon Student · 2. Get an EBT or Medicaid Discount · 3. Spend $25 or More · 4. Get a Subscribe & Save Membership · 5. Swap Amazon Prime for Walmart+. They get exclusive deals on select everyday favorites, essentials, prepared foods, and more at Amazon Fresh stores—and a discount off hundreds of sale items. Call Amazon, if this is the first time you are getting the membership they might be able to give you a discount. Upvote Downvote Reply. Start your 6-month trial and then enjoy Prime at half the price. As a member, you'll get access to fast FREE shipping, Prime Video originals. If you are a non-student young adult ( years old) and join Prime Student through age verification, when you reach 25 years old, your Prime Student.

How To Set Up Prime Exclusive Discounts on Amazon Seller Central · Must be in new condition · Must be Fulfilled by Amazon · Have at least a 3-star rating or no. While Amazon no longer offers an individual Prime teacher discount, they do offer a program to educational organizations called Amazon Business. Amazon reports. Save 50% on Amazon Prime for qualifying EBT and government assistance recipients. Free delivery, plus films, TV programmes, eBooks, ad-free songs. If you receive SNAP, Medicaid, or other qualifying government assistance, you can save more with Prime Access. · Medicaid: Upload image of your Medicaid. Go to spooncms.ru · Select Get Started. · Follow the on-screen instructions to verify your EBT card or another qualifying document. Qualifying EBT and government assistance recipients can save 50% on the monthly Prime membership. Verify your eligibility for Prime Access. Prime members get an extra 10% off sale items (excluding alcohol) plus special deals on seasonal favorites. Learn more. Grocery delivery or pickup. Prime. Amazon Prime does not have a discount for seniors who receive Social Security benefits. However, Social Security recipients who also receive SSI benefits may. I'm already a StudentUniverse member, how do I use my Prime Student account to get more discounts? One such way is to take advantage of Amazon's coupons and promotional codes. These coupons can be found on the product pages of eligible items or on Amazon's. Prime Members can now get all their groceries delivered from Whole Foods Market and Must identify as a Prime member to receive Prime member discount. Amazon Prime - Senior Discount? · Go to spooncms.ru · Select Get Started. · Follow the on-screen instructions to verify your EBT card or another. The simplest is to click on "Today's Deals" to bring up Amazon's Gold Box discounts, which can include coupons, lightning deals, deals of the day, and Prime. Prime members get an extra 10% off sale items (excluding alcohol) plus special deals on seasonal favorites. Learn more. Grocery delivery or pickup. Prime. I'm already a StudentUniverse member, how do I use my Prime Student account to get more discounts? Deals and Discounts, Compliments of Amazon Family: Get up to 20% off diapers, baby food, and more through Subscribe & Save and 15% off eligible products from. If you're a college student or between the ages of , get Amazon Prime free for 6 months plus 50% off subsequent months with Prime Student. Your discount. Looking for a discount on Amazon Prime membership? Our fantastic offer on Amazon Prime vouchers is the smart solution. Get Rs off on the 1-year plan. Make sure you are logged in to your Amazon Prime account. · Browse through eligible products to find items that have Prime discounts available. · Once you've. No minimum order size; Upgrades to one-day shipping for $/item; Email alerts for exclusive deals and promotions. Getting the Discount. Visit.

2 3 4 5 6